Featured post

Top 5 books to refer for a VHDL beginner

VHDL (VHSIC-HDL, Very High-Speed Integrated Circuit Hardware Description Language) is a hardware description language used in electronic des...

Wednesday, 2 September 2015

Intel's Skylarke Processors for PCs, Tablets and Servers

Friday, 9 January 2015

Button-Size Wearable Computer by Intel

Intel CEO Brian Krzanich showed off a minuscule computer, dubbed Curie, during a keynote speech at the International Consumer Electronics Show in Las Vegas on Tuesday. Krzanich plucked a button off his blazer before explaining that it contained a Curie demo module.

Curie is a sure sign that hardware makers are eager to build wearable devices of all kinds. It also points to the unwelcome size of many existing smart watches and smart glasses.

Intel’s new device will include a Bluetooth low-energy radio, motion sensors, and components designed to rapidly and precisely differentiate between different types of physical activity. Krzanich said Curie will run “for extended periods of time” on a coin-size battery and would be available in the second half of the year.

Curie appeared much smaller than a postage-stamp-size computer, called Edison, that Krzanich showed off at last year’s CES.

The world’s largest chip maker evidently sees wearables as one of the most important categories in consumer electronics. It’s a belief held by a lot of other companies at CES, where gadgets meant to be worn on the body or clipped to clothing were all over the show floor this year (see “CES 2015: Wearables Everywhere”).

To make it clear that Curie is already functional, the company built a simple step-tracking smartphone app to go with the module Krzanich had on him; at one point he pulled the phone out of his pocket, and its display indicated he’d taken 1,788 steps during the keynote.

As part of its wearables push, Intel has partnered with a number of companies in the fashion and accessories businesses, including Luxottica Group, which is the world’s largest eyeglass maker with brands such as Ray-Ban and Oakley. Krzanich said Luxottica will use Curie to make “truly consumer-friendly” smart glasses—a notoriously tricky thing to do, in part because of the size of components needed to make them work.

Oakley CEO Colin Baden joined Krzanich on stage to talk about wearables, which Oakley has built in the form of devices like ski goggles that include a head-up display. When you put a wearable device on your face, Baden said, it becomes part of your personality. “It’s important the form factor compress so the electronic component of it doesn’t become burdensome,” he said.

Sunday, 30 November 2014

Intel funding to develop printer for blind

Shubham Banerjee, CEO of the Braille printer maker Braigo Labs, had closed an early round funding with Intel Capital, the company's venture capital arm, last month to develop a prototype of low-cost Braille printer.

But to attend the event, Banerjee had to take the day off from middle school. That’s because he’s just 13 years old — making him, quite possibly, the youngest recipient of venture capital in Silicon Valley history. (He’s definitely the youngest to receive an investment from Intel Capital.)

“I would like all of us to get together and help the visually impaired, because people have been taking advantage of them for a long time,” Banerjee said. “So I would like that to stop.”

By “taking advantage,” Banerjee is referring to the high price of Braille printers today, usually above $2,000. By contrast, Braigo Labs plans to bring its printer to market for less than $500.

Banerjee has invented a new technology that will facilitate this price cut. Patent applications are still pending, so he wouldn’t divulge any of the details. But the technology could also be used to create a dynamic Braille display — something that shows one line of text at a time by pushing small, physical pixels up and down, and which currently costs $6,500, according to Braigo advisor Henry Wedler, who is blind.

Banerjee also figures that volume production will help keep the price low. Currently, Braille printers cost so much because the demand is low, so current manufacturers need to set a high price in order to recoup their costs.

“The truth is that demand is low in the U.S.,” Banerjee told me. But, he added, if you brought the price low enough there would be huge demand outside the U.S.

Banerjee built the version version of his Lego Braille printer for a science fair. He didn’t know anything about Braille beforehand. In fact, he’d asked his parents how blind people read, he said onstage, and they were too busy to answer. “Go Google it,” he said they told him, so he did.

After learning about Braille, he came up with the idea to make a Braille printer. He showed it at his school’s science fair, then later entered it into the Synopsys Science & Technology Championship, where he won first prize, which included a big trophy and a $500 check.

After that, he started getting a lot of attention on his Facebook page. People kept asking him if they could buy one, he said, which led to the idea of creating a company.

Lego was just for the first prototype, by the way: Future versions will be made with more traditional materials.

So how did Intel come to invest in such a young inventor? His father, Niloy, works for Intel — but that’s not exactly how it happened, according to Niloy.

After working with the beta version of Intel Edison (the chip company’s tiny embeddable microprocessor) at a summer camp, Banerjee’s project came to the attention of Intel, which invited him to show off his printer at the Intel Developer Forum. After appearing at IDF, Intel Capital came calling.

Young Banerjee seems composed in front of crowds, which should serve him well. (That’s not surprising, given that Braigo’s website touts coverage on everything from BoingBoing and SlashGear to CNN and NPR.) When asked onstage, in front of 1,000 entrepreneurs, investors, and Intel employees, how he knew that the printer worked even though he doesn’t read Braille, Banerjee answered immediately, “I Googled it.” The crowd laughed.

“I’m happy that I live in Silicon Valley,” Banerjee said. “So many smart people.”

Wednesday, 16 April 2014

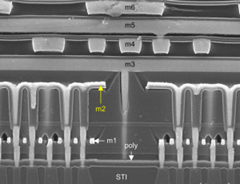

Intel’s e-DRAM

Sunday, 26 January 2014

Intel Introduces 2 Ultra-Low-Power Mobile Chips

The Haswell rollout has solidified the company's dominance in the computer chip business (including what it claims are record sales of desktop Core i7 CPUs), especially on the mobile side of things. Intel is looking to further its advantage with the release of a new batch of fourth-generation Core processors designed for notebooks.

The nine new mobile Haswell CPUs are a mix of Core i5 and i7 chips that will power performance portables, though a couple are ultra-low-voltage (ULV) processors that can be used in Ultrabooks.The cheapest new one is the i5-4310M at $225 (prices will factor into the cost of a new notebook, as the laptop upgrade market is neglible); its two cores run at 2.7GHz. For about $40 more, the i5-4340M goes to 2.9GHz, while for svelte systems, there's the 2GHz i5-4310U and the 1.5GHz 4360U. Despite the slower clock speed, the 4360U costs more than the other ULV chip because it makes use of Intel's more powerful HD 5000 graphics.

Even though these are new processors, they aren't a quantum leap beyond their predecessors. Because they are clocked about 100MHz higher than the initial Haswell CPUs, that's only about a few percentage points better in performance. But who's going to argue with faster, especially when it's going to be baked into new laptops over the next few months.

Sunday, 27 January 2013

A Realistic Assessment of the PC's Future

All around us, the evidence is overwhelming that the PC world is changing rapidly and in numerous ways -- use, sales, share of the electronics/IT equipment market, application development, and, very importantly, the surrounding supply chain.

Certainly, the PC has a future in our homes and businesses, but don't let anyone convince you they know exactly how that future will look or where things will remain the same over the next five years. Within a few years, the PC market will lose its title as the dominant consumer of semiconductors -- if it hasn't already. In the near future, the leading destination for many components used in traditional PCs will be tablet and smartphone plants.

The supply chain, especially the procurement and production elements, must be focused on accelerating that transition. I don't believe that's the case today, though the trends have been apparent for quite a few quarters. As consumers have migrated toward mobile devices, especially smartphones, the consequences for PC vendors and their component suppliers have become obvious. But apparently, they aren't obvious enough.

Intel Corp., the company with the most to lose as this shift has accelerated, has worked to establish a beachhead in the smartphone market. Nevertheless, many well-meaning analysts and industry observers have continued to spout the misleading view that the PC sector is unshakeable. The general opinion for a while was that tablets and smartphones would serve as complementary products to the traditional PCs, rather than cannibalizing the market. Think again.

Paul Otellini, Intel's president and CEO, had this to say about the changes in his company's market during a fourth-quarter earnings conference call.

From a product perspective, 2012 was a year of significant transitions in our markets and a year of important milestones for Intel...

At CES last week, I was struck by our industry's renewed inventiveness. PC manufacturers are embracing innovation as we are in the midst of a radical transformation of the computing experience with the blurring of from factors and the adoption of new user interfaces.

It's no longer necessary to choose between a PC and a tablet.

Let's turn to an IDC report released Monday for further explanation. The research firm said it sees PC innovation accelerating over the next few years as OEMs struggle to stem their losses and blunt the impact of smart phones on the market. PC OEMs and chip vendors can no longer afford to be complacent, IDC said; they must compete on all levels with tablets and Smartphone manufacturers to demonstrate the continued relevance of their products.

This view implies that PC vendors and their suppliers have been satisfied with the status quo until now. That would be putting it mildly. Until Apple Inc. rolled out the iPhone and positioned it as an alternative platform for accessing the Internet, many OEMs didn't see smartphones as competing devices. IDC said in its report:

Complacency and a lack of innovation among OEM vendors and other parts of the PC ecosystem has occurred over the past five years. As a result, PC market growth flattened in 2012 and may stagnate in 2013 as users continue gravitating to ever more powerful smartphones and tablets.

Ouch. Some in the industry still believe tablets and smartphones aren't an arrow aimed at the PC market. I don't see tablets and smartphones replacing PCs in all situations, but they will encroach enough on that territory to leave a visible mark. That's why PC vendors, semiconductor suppliers, and manufacturers of other components need to develop a strategy that embraces the smaller form factors of tablets and smartphones and leverage their advantages over traditional computing platforms to create market-winning products.

Mario Morales, program vice president for semiconductors and EMS at IDC, said in a press release, "The key challenge will not be what form factor to support or what app to enable, but how will the computing industry come together to truly define the market's transformation around a transparent computing experience."

That conversation is a couple of years late, but it's welcome nonetheless.

Wednesday, 23 January 2013

IHS iSuppli: IC inventories hit record levels in Q3

hip inventories reached record highs near the end of 2012, and according to IHS iSuppli, semiconductor revenue will decline in Q1, prompting new concerns about the state of the market.

Overall semiconductor revenue is expected to slide three percent between January and March 2013, on top of a 0.7 percent decline in Q4 2012. What's more, inventory reached record levels in Q3 2012, amounting to 49.3 percent of revenue, more than at any point since Q1 2006. IHS iSuppli believes the uncomfortably high level of inventory points to the failure of key demand drivers to materialize.

The PC market remains slow and hopes of a Windows 8 renaissance have turned into a nightmare. Bellwether Intel saw its revenue drop three percent in Q4, with profit tumbling 27 percent, and the trend is set to continue. AMD is expected to announce its earnings Tuesday afternoon and more gloom is expected across the board. The only bright spot in an otherwise weak market is TSMC, which quickly rebounded after posting the lowest revenues in two years a year ago. TSMC now expects to see huge demand for 28nm products in 2013 and many observers point to a possible deal with Apple.

In addition, TSMC plans to invest $9 billion in capital expenditure in 2013, and it will likely spend even more in 2014, as it moves to ramp up 20nm production. However, Intel's plans to increase capital spending to $13 billion, up $2 billion over 2012 levels, have not been welcomed by analysts and investors. Unlike TSMC, Intel is not investing to increase capacity in the short term, it is making a strategic bet on 450mm wafer technology, which promises to deliver significantly cheaper chips compared to existing 300mm wafers. However, 450mm plants are still years away.

TSMC's apparent success has a lot to do with high demand for Smartphone's and tablets, which are slowly eating into the traditional PC market. Semiconductor shipments for the wireless segment were expected to climb around four percent in 2012 and positive trends were visible in analog, logic and NAND components. However, the mobile boom can't last forever, and we are already hearing talk of "Smartphone fatigue" and "peak Apple".

IHS iSuppli estimates the first quarter of 2013 will see growth in industrial and automotive electronics and other semiconductor markets will eventually overcome the seasonal decline, so a rebound is expected in the second and third quarters.

Semiconductor revenue could grow by four percent in the second, and nine percent in the third quarter. However, the assumptions are based on a wider economic recovery, which is anything but certain at this point. If demand evaporates, semiconductor suppliers could find themselves hit by an oversupply situation, leading to more inventory write-downs throughout the year.

Tuesday, 15 January 2013

SEMI Industry spending $32.4B this year on IC gear

Spending on fab equipment for System LSI is expected to drop in 2013. Spending for Flash declined rapidly in 2H12 (by over 40 %) but is expected to pick up by 2H13. The foundry sector is expected to increase spending in 2013, led by major player TSMC, as well as Samsung and Global foundries.

Fab construction:

While fab construction spending slowed in 2012, at -15%, SEMI projects an increase of 3.7 % in 2013 (from $5.6bn in 2012 to $5.8bn in 2013).

The report tracks 34 fab construction projects for 2013 (down from 51 in 2012). An additional 10 new construction projects with various probabilities may start in 2013. The largest increase for construction spending in 2013 is expected to be for dedicated foundries and Flash related facilities.

Many device manufacturers are hesitating to add capacity due to declining average selling prices and high inventories.

However SEMI reckons flash capacity will grow 6% by mid-2013, with nearly 6 % growth, adding over 70,000wpm.

SEMI also foresees a rapid increase of installed capacity for new technology nodes, not only for 28nm but also from 24nm to 18nm and first ramps for 17nm to 13nm in 2013.

SEMI cautiously forecasts fab equipment spending in 2013 to range from minus 5 to plus 3.

Monday, 5 November 2012

Intel's 335 Series SSD reviewed

SSDs have come a long way since Intel released its first, the X25-M, a little more than four years ago. That drive was a revelation, but it wasn't universally faster than the mechanical hard drives of the era. The X25-M was also horrendously expensive; it cost nearly $600 yet offered just 80GB of capacity, which works out to about $7.50 per gigabyte.

My, how things have changed.

More importantly, SSDs have become a lot more affordable. Today, you can get 80GB by spending $100. The sweet spot in the market is the 240-256GB range, where SSDs can be had for around $200—less than a dollar per gigabyte. Rabid competition between drive makers deserves some credit for falling prices, particularly in recent years. Moore's Law is the real driving factor behind the trend, though. The X25-M's NAND chips were built using a 50-nm process, while the new Intel 335 Series uses flash fabricated on a much smaller 20-nm process.

Designed for enthusiasts and DIY system builders, the 335 Series is aimed squarely at the sweet spot in the market with a 240GB model priced at $184. That's just 77 cents per gig, a tenfold reduction in cost in just four years. The price is right, but what about the performance? We've run Intel's latest through our usual gauntlet of tests to see how it stacks up against the most popular SSDs around.

Die shrinkin'

Intel and Micron have been jointly manufacturing flash memory since 2006 under the name IM Flash Technologies. The pair started with 72-nm NAND flash before moving on to the 50-nm chips used in the X25-M. The next fabrication node was 34 nm, which produced the chips used in the second-generation X25-M and the Intel 510 Series. 25-nm NAND found its way into the third-gen X25-M, otherwise known as the 320 Series, in addition to the 330 and 520 Series. Now, the Intel 335 Series has become the first SSD to use IMFT's 20-nm MLC NAND.

Building NAND on finer fabrication nodes allows more transistors to be squeezed into the same unit area. In addition to accommodating more dies per wafer, this shrinkage can allow more capacity per die. The 34-nm NAND used in the Intel 510 Series offered 4GB per die, with each die measuring 172 mm². When IMFT moved to 25-nm production for the 320 Series, the per-die capacity doubled to 8GB, while the die size shrunk slightly to 167 mm².

The Intel 335 Series' 20-nm NAND crams 8GB onto a die measuring just 118 mm². That's not the doubling of bit density we enjoyed in the last transition, but it still amounts to a 29% reduction in die size for the same capacity. Based on how those dies fit onto each wafer, Intel says 20-nm production increases the "gigabyte capacity" of its flash fabs by approximately 50%. IMFT has been mass-producing these chips since December of last year.

As NAND processes shrink, the individual cells holding 1s and 0s get closer together. Closer proximity can increase the interference between the cells, which can degrade both the performance and the endurance of the NAND. Intel's solution to this problem is a planar cell structure with a floating, high-k/metal gate stack. This advanced cell design is purportedly the first of its kind in the flash industry, and Intel claims it delivers performance and reliability comparable to IMFT's 25-nm NAND. Indeed, Intel's performance and endurance specifications for the 335 Series 240GB exactly match those of its 25-nm sibling in the 330 Series.

Intel says the 335 Series 240GB can push sequential read and write speeds of 500 and 450MB/s, respectively. 4KB random read/write IOps are pegged at 42,000/52,000. Thanks to the lower power consumption of its 20-nm flash, the new drive should be able to hit those targets while consuming less power than its predecessor. The 335 Series is rated for power consumption of 275 mW at idle and 350 mW when active, less than half the 600/850 mW ratings of its 25-nm counterpart.

On the endurance front, Intel's new hotness can supposedly withstand 20GB of writes per day for three years, just like the 330 Series. As one might expect, the drive is covered by a three-year warranty. Intel reserves its five-year SSD warranties for the 320 and 520 Series, whose high-endurance NAND is cherry-picked off the standard 25-nm production line. I suspect it will take Intel some time to bin enough higher-grade, 20-nm NAND to fuel upgrades to those other models.

Our performance results will illustrate how the 335 Series compares up to those other Intel SSDs. Expect the 320 Series to be much slower due to its 3Gbps Serial ATA interface. That drive's Intel flash controller can trace its roots back to the original X25-M, so the design is a little long in the tooth. The 520 Series, however, has a 6Gbps interface and higher performance specifications than the 335 Series. The two are based on the same SandForce controller silicon, though.

Intel’s 335 Series SSD

But what may be of most interest to consumers is that the Series 335 is significantly cheaper per gigabyte: Intel expects this 240GB drive to cost about the same as a 180GB Series 330. And while the product was officially embargoed until 8:30 a.m. on October 29, we saw it listed for sale online the evening of October 28 at prices between $184 and $225, including shipping.

Like its most recent predecessors, the Series 335 is outfitted with a SATA revision 3.0 (6gbits/s) interface, and the drive comes housed inside a 2.5-inch enclosure that is 9.5mm thick. That thick profile renders it unsuitable for many current ultraportables; however, the stout of heart can easily remove the board from its enclosure and fit it inside a thinner case or install it directly into a vacant drive bay (although doing either will likely void Intel’s three-year warranty).

Here are some results of 10GB copy and read tests. Keeping in mind that our current test bed uses a 7200-rpm hard drive to feed and read data from our test subjects, the 335 performed very well. It wrote our 10GB mix of files and folders at 93.2MBps and read them at 57.9MBps; and it wrote our single 10GB file at 124.1MBps while reading it at 129.8MBps.

Intel 335 Series SSD Features and Specifications:

- CAPACITY: 240GB

- COMPONENTS:

- Intel 20nm NAND Flash Memory

- Multi-Level Cell (MLC)

- FORM FACTOR: 2.4-inch

- THICKNESS: 9.5mm

- WEIGHT: Up to 78 grams

- SATA 6Gbps BANDWIDTH PERFORMANCE (IOM QD32):

- SUSTAINED SEQ READ: 500 MB/s

- SUSTAINED SEQ WRITE: 450 MB/s

- READ & WRITE IOPS (IOM QD32):

- RANDOM 4KB READS: Up to 42,000 IOPS

- RANDOM 4KB WRITES: Up to 52,000 IOPS

- COMPATIBILITY:

- Intel SSD Toolbox w/SSD Optimizer

- Intel Data Migration Software

- Intel Rapid Storage Technology

- Intel 6 Series Express Chipsets (w/ SATA 6Gpbs)

- SATA Revision 3.0

- ACS-2 (ATA/ATAPI Command Set 2)

- Limited SMART ATA Feature Set

- Native Command Queuing (NCQ) Command Set

- Data Set Management Command Trim Attribute

- POWER MANAGEMENT:

- 5 V SATA Supply Rail

- SATA Link Power Management (LPM)

- POWER:

- Active (MobileMark 2007 Workload: 350 mW (TYP)

- Idle: 275 mW (TYP)

- TEMPERATURE:

- Operating: 0°C to 70°C

- Non-Operating: -55°C to 95°C

- CERTIFICATIONS & DECLARATION:

- UL

- CE

- C-Tick

- BSMI

- KCC

- Microsoft WHQL

- VCCI

- SATA-IO

- PRODUCT ECOLOGICAL COMPLIANCE:

- RoHS

Wednesday, 24 October 2012

Intel's Haswell chips coming into your PC in first half of next year

Laptops and desktops with Intel's next-generation Core processor, code-named Haswell, will be available in the first half of next year, Intel CEO Paul Otellini said during a financial conference call on Tuesday.

The Haswell chip will succeed current Core processors code-named Ivy Bridge,which became widely available in April. Intel has said that Haswell will deliver twice the performance of Ivy Bridge, and in some cases will double the battery life of ultrabooks, which are a new category of thin and light laptops with battery life of roughly six to eight hours.

Intel shed some light on Haswell at its Intel Developer Forum trade show in September, saying its power consumption had been cut to the point where the chips could be used in tablets. Haswell chips will draw a minimum of 10 watts of power, while Ivy Bridge's lowest power draw is 17 watts. Intel has splintered future Haswell chips into two families: 10-watt chips for ultrabooks that double as tablets, and 15-watt and 17-watt chips designed for other ultrabooks and laptops.

Haswell will be "qualified for sale" in the first half of 2013, said Stacy Smith, chief financial officer at Intel, during the conference call. Chips go through a qualification process internally and externally, after which Intel can put the chip into production.

The Haswell chip could provide a spark to the ultrabook segment, which has stagnated in a slumping PC market. Worldwide PC shipments dropped between 8 percent and 9 percent during the third quarter, according to research firms IDC and Gartner. They said ultrabook sales were lower than expected due to high prices and soft demand for consumer products.

Many ultrabook models with Ivy Bridge processors are expected to ship in the coming weeks with the launch of Windows 8, which is Microsoft's first touch-centric OS. Otellini said more than 140 Core-based ultrabooks will be in the market, of which 40 will have touch capabilities. A few models -- between five and eight -- will be convertible ultrabooks that can also function as tablets. A majority of the ultrabooks will have prices either at or above US$699, with a few models perhaps priced lower, Otellini said.

The new graphics processor in Haswell will support 4K graphics, allowing for a resolution of 4096 by 3072 pixels. Ultrabooks with Haswell will also include wireless charging, NFC capabilities, voice interaction and more security features.

Otellini said Intel can't tell how the segment will perform in the coming quarter. A number of factors needed to be considered including Microsoft's Windows 8 and the launch of new ultrabooks, he said. Intel reported a profit and revenue decline in the third fiscal quarter of 2012.

"We saw a softening in the consumer segments" in the third fiscal quarter, Otellini said. "The surprise there was China, which was strong, [but] turned weak on us."

Tablets have changed the way people use computers, and Microsoft is bringing touch to mainstream PCs for the first time with Windows 8, Otellini said. PCs with Windows 8 are expected to ship later this month, and it's hard to predict what the response will be until people go out and play with the devices and the OS, Otellini said.

"I see the computing market in a period of transition," with an opportunity for breakthroughs in research and creativity, Otellini said. New usage models for laptops are emerging with detachable touchscreens, voice recognition and other features, and Intel is trying to tap into those opportunities, Otellini said.

The company has a history of overcoming slumps through research and innovation, Otellini said.

Monday, 10 September 2012

Intel Is Cooling Entire Servers By Submerging Them in Oil

Don't panic, though: they're using mineral oil, which doesn't conduct electricity. It's a pretty wacky idea, but it seems to be working. After a year of testing with Green Revolution Cooling, Intel has observed some of the best efficiency ratings it's ever seen. Probably most impressive is that immersion in the oil doesn't seem to affect hardware reliability.

All up, it's extremely promising: completely immersing components in liquid means you can pack components in more tightly as the cooling is so much more efficient. For now, though, it's probably best to avoid filling your computer case with liquid of any kind.

Monday, 3 September 2012

Intel Chips Will Support Wireless Charging by 2014

Earlier this month it was rumored that Intel was developing a new wireless charging solution it could integrate into the Ultrabook platform. In so doing, it would remove the need to plug your Ultrabook into a power socket directly, instead placing it on a charging pad or at least near a power source.

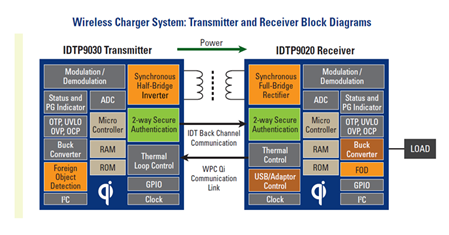

Intel’s interest in wireless charging has today been confirmed through a new partnership with Integrated Device Technology (IDT). IDT will develop a new integrated transmitter and receiver for Intel, allowing for wireless charging using resonance technology from up to several feet away.

“Our extensive experience in developing the innovative and highly integrated IDTP9030 transmitter and multi-mode IDTP9020 receiver has given IDT a proven leadership position in the wireless power market,” said Arman Naghavi, vice president and general manager of the Analog and Power Division at IDT.

IDT’s Gary Huang has also suggested that eventually wireless charging will expand to power everything on your desktop. So your wireless keyboard, mouse, backup storage device, smartphone, and PC/laptop will all be completely wireless, with each including the necessary components and battery to be charged.

The chipmaker is entering a market where there is already a proposed standard called Qi. Qi has received a wide array of support, including Energizer, Texas Instruments, Verizon, and phone manufacturers including Nokia, Research In Motion, LG, and HTC.

Currently, 88 products are listed by the Wireless Power Consortium as being Qi-compatible, including phones from NTT DoCoMo and HTC.

Intel is not a part of that group, and its wireless charging effort is based ona platform created by IDT is apparently not Qi-compatible. Since Qi is already getting widespread support and Intel’s chips have made it in to very few mobile devices so far, Intel has some work ahead if it is to be a success.

A completely wire-free desk at home sounds great to me, and if this IDT/Intel venture is successful it could be a reality within a year or two.

Sunday, 26 August 2012

Inside TSMC – A FAB Tour

An up to date and current overview of semiconductor manufacturing technology from TSMC in Taiwan. Nicely produced and informative if you tune-out the voice-over slightly. Better access than any Fab tour.

Recommended if you have any interest in how semiconductors are made/manufactured in volume right now.

In the microelectronics industry a semiconductor fabrication plant (commonly called a fab) is a factory where devices such as integrated circuits are manufactured.

A business that operates a semiconductor fab for the purpose of fabricating the designs of other companies, such as fabless semiconductor companies, is known as a foundry. If a foundry does not also produce its own designs, it is known as a pure-play semiconductor foundry.

Fabs require many expensive devices to function. Estimates put the cost of building a new fab over one billion U.S. dollars with values as high as $3–4 billion not being uncommon. TSMC will be investing 9.3 billion dollars in its Fab15 300 mm wafer manufacturing facility in Taiwan to be operational in 2012.

The central part of a fab is the clean room, an area where the environment is controlled to eliminate all dust, since even a single speck can ruin a microcircuit, which has features much smaller than dust. The clean room must also be dampened against vibration and kept within narrow bands of temperature and humidity. Controlling temperature and humidity is critical for minimizing static electricity.

The clean room contains the steppers for photolithography, etching, cleaning, doping and dicing machines. All these devices are extremely precise and thus extremely expensive. Prices for most common pieces of equipment for the processing of 300 mm wafers range from $700,000 to upwards of $4,000,000 each with a few pieces of equipment reaching as high as $50,000,000 each (e.g. steppers). A typical fab will have several hundred equipment items.

Taiwan Semiconductor Manufacturing Company, Limited or TSMC is the world's largest dedicated independent semiconductor foundry, with its headquarters and main operations located in the Hsinchu Science Park in Hsinchu, Taiwan.

Facilities at TSMC:

- One 150 mm (6 inches) wafer fab in full operation (Fab 2)

- Four 200 mm (8 inches) wafer fabs in full operation (Fabs 3, 5, 6, 8)

- Two 300 mm (12 inches) wafer fabs in production (Fabs 12, 14)

- TSMC (Shanghai)

- WaferTech, TSMC's wholly owned subsidiary 200 mm (8 inches) fab in Camas, Washington, USA

- SSMC (Systems on Silicon Manufacturing Co.), a joint venture with NXP Semiconductors in Singapore which has also brought increased capacity since the end of 2002

TSMC announced plans to invest US$9.4 billion to build its third 12-inch (300 mm) wafer fabrication facility in Central Taiwan Science Park (Fab 15), which will use advanced 40 and 20-nanometer technologies. It is expected to become operational by March 2012. The facility will output over 100,000 wafers a month and generate $5 billion per year of revenue. On January 12, 2011, TSMC announced the acquisition of land from Powerchip Semiconductor for NT$2.9 billion (US$96 million) to build two additional 300 mm fabs to cope with increasing global demand. Further, TSMC has disclosed plans that it will build a 450-mm fab, which may begin its pilot lines 2013, and production as early as 2015.

Monday, 30 July 2012

To 20nm and beyond: ARM targets Intel with TSMC collaboration

The multi-year deal sees ARM tie itself even closer to TSMC, its chip-fabber of choice, as it looks to capitalise on the company's technology to help it maintain a lead over Intel for chip power efficiency.

Under the deal, the Cambridge-based chip designer has agreed to share technical details with TSMC to help the fabricator make better chips with higher yields, ARM said on Monday. TSMC will also share information, so that ARM can create designs better suited to its manufacturing.

"By working closely with TSMC, we are able to leverage TSMC's ability to quickly ramp volume production of highly integrated SoCs [System-on-a-Chip processors] in advanced silicon process technology," Simon Segars, general manager for ARM's processor and physical IP divisions, said in a statement.

"The ongoing deep collaboration with TSMC provides customers earlier access to FinFET technology to bring high-performance, power-efficient products to market," he added.

The move should keep ARM's chip designs competitive with Intel's in the server market. TSMC's FinFET is akin to Intel's 3D 'tri-gate' method of designing processors with greater densities, which should deliver greater power efficiency and better performance from a cost point of view.

By tweaking its chips to TSMC's process, ARM chips should deliver good yields on the silicon, keeping prices low while maintaining the higher power efficiency that comes with a lower process node.

ARM's chips dominate the mobile device market, but unlike Intel, it doesn't have a brand presence on the end devices. Instead, companies license its designs, go to a manufacturer, and rebrand the chips under their own name. You may not have heard of ARM, but the Apple, Qualcomm and Nvidia chips in mobile devices, as well as Calxeda and Marvell's server chips, are all based to some degree on based on ARM's low-power RISC-architecture processors.

64-bit processors

As part of the new deal, ARM is expecting to work with TSMC on 64-bit processors. It stressed how the 20nm process nodes provided by the fabber will make its server-targeted chips more efficient, potentially cutting datacentre electricity bills.

"This collaboration brings two industry leaders together earlier than ever before to optimise our FinFET process with ARM's 64-bit processors and physical IP," Cliff Hou, vice president of research and development for TSMC, said in the statement. "We can successfully achieve targets for high speed, low voltage and low leakage."

"We can successfully achieve targets for high speed, low voltage and low leakage" — Cliff Hou, TSMC

However, ARM only released its 64-bit chips in October, putting these at least a year and a half away from production, as licensees tweak designs to fit their devices. Right now, there are few ARM-based efforts pitched at the enterprise, aside from HP's Redstone Server Development platform and a try-before-you-buy ARM-based cloud for the OpenStack software.

Production processes

AMD, like ARM, does not operate its own chip fabrication facilities and so must depend on the facilities of others. AMD uses GlobalFoundries, while ARM licensees have tended to use TSMC. However, both TSMC and GlobalFoundries are a bit behind Intel in terms of the level of detail — the process node — they can make their chips to.

Right now, TSMC is still qualifying its 20nm process for certification by suppliers, while Intel has been shipping its 22nm Ivy Bridge processors for several months. Intel has claimed a product roadmap down to 14nm via use of its tri-gate 3D transistor technology, while TSMC is only saying in the ARM statement it will go beyond 20nm, without giving specifics.

Even with this partnership, Intel looks set to maintain its lead in advanced silicon manufacturing.

"By the time TSMC gets FinFET into production - earliest 2014, it's only just ramping 28nm [now] - Intel will be will into its 2nd generation FinFET buildout," Malcolm Penn, chief executive of semiconductor analysts Future Horizons, told ZDNet. This puts Intel "at least three years ahead of TSMC. Global Foundries will be even later."

Intel has noticed ARM's rise and has begun producing its own low-power server chips under the Centerton codename. However, these chips consume 6W compared with ARM's 5W.

At the time of writing, neither ARM nor TSMC had responded to requests for further information. Financial terms, if any, were not disclosed.

-

This is 8-bit microprocessor with 5 instructions. It is based on 8080 architecture. This architecture called SAP for Simple-As-Possible comp...

-

Formal Definition A procedure is a subprogram that defines algorithm for computing values or exhibiting behavior. Procedure call is a state...

-

VHDL (VHSIC-HDL, Very High-Speed Integrated Circuit Hardware Description Language) is a hardware description language used in electronic des...

-

Counters are generally made up of flip-flops and logic gates. Like flip-flops, counters can retain an output state after the input condition...

-

In a digital circuit, counters are used to do 3 main functions: timing, sequencing and counting. A timing problem might require that a high...